Unit 2 Test - Checking (fixed)

star

star

star

star

star

Last updated over 1 year ago

33 questions

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

4

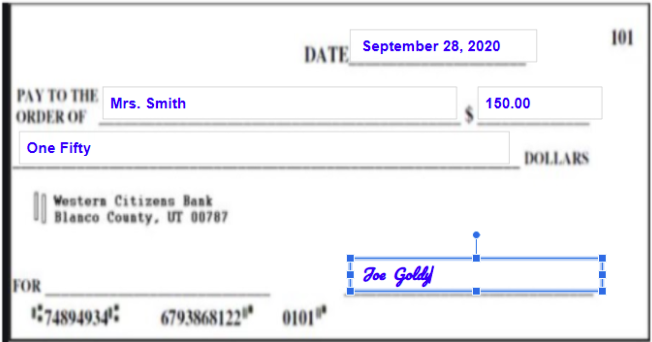

Tiana has $125 in her checking account. She wants to make a purchase for $160. Explain what would happen if:a) she had overdraft protectionb) she did not have overdraft protection

| Draggable item | arrow_right_alt | Corresponding Item |

|---|---|---|

helps avoid fees | arrow_right_alt | having overdraft protection |

transaction will not go through | arrow_right_alt | not having overdraft fees |

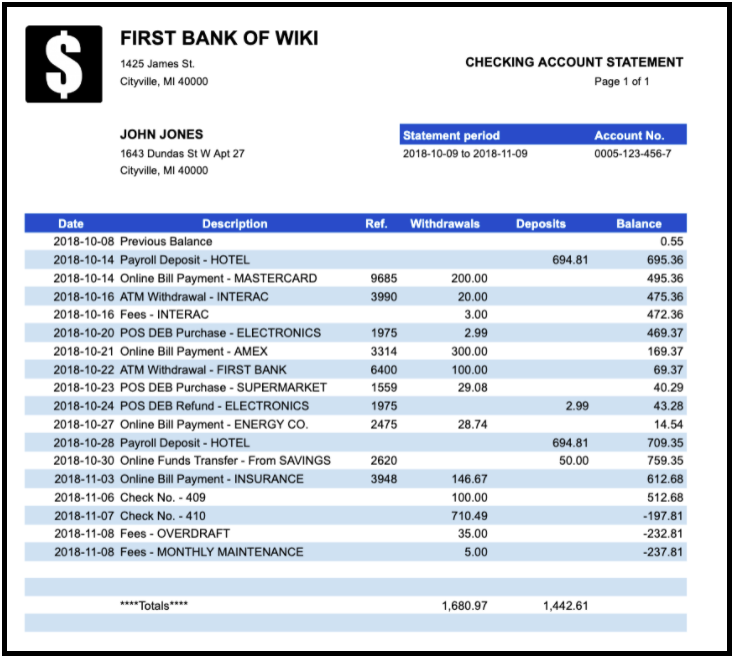

What is the impact of the Online Funds Transfer - From Savings that appears on John's statement?