BAF 3M 🏁 Ch. 6 RETAKE A

star

star

star

star

star

Last updated over 1 year ago

20 questions

Note from the author:

There are several parts to this assessment.

Part 1: Fill in the Blank

Part 2: Taxes

Part 3: Source Documents

Part 4: HST Schedule, Journal Entries, and Taxes in Google Sheets

There are several parts to this assessment.

Part 1: Fill in the Blank

Part 2: Taxes

Part 3: Source Documents

Part 4: HST Schedule, Journal Entries, and Taxes in Google Sheets

Part 1: Fill in the Blank

1

1

2

1

1

1

1

1

1

1

Part 2: Taxes

3

3

3

3

3

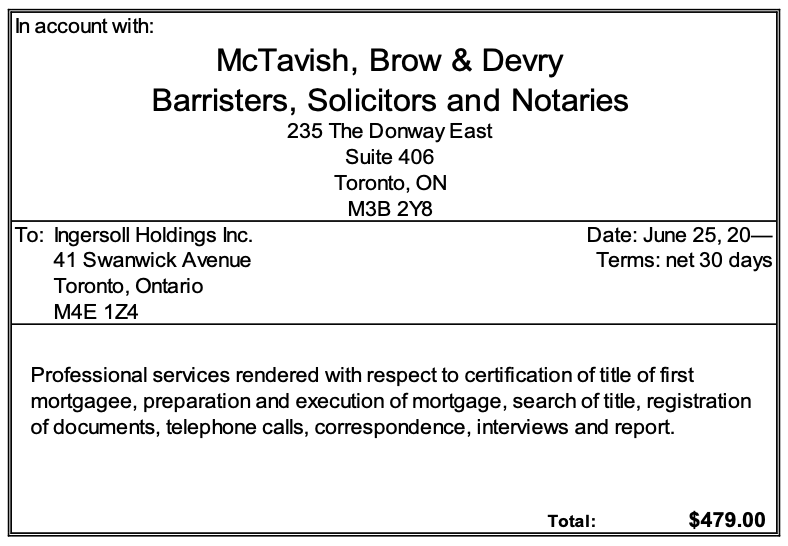

Part 3: Source Documents