2.1-2.5 Tests 2024

star

star

star

star

star

Last updated about 1 year ago

24 questions

1

1

1

2

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

1

| Draggable item | arrow_right_alt | Corresponding Item |

|---|---|---|

debit | arrow_right_alt | money paid to bank when they lend you money because account balance is below zero. |

overdraft fee | arrow_right_alt | a printed/electronic account record of debits, credits and interest over a certain amount of time |

account number | arrow_right_alt | unique set of numbers assigned to an account holder |

bank statement | arrow_right_alt | amount removed from an account to pay for goods or services |

| Draggable item | arrow_right_alt | Corresponding Item |

|---|---|---|

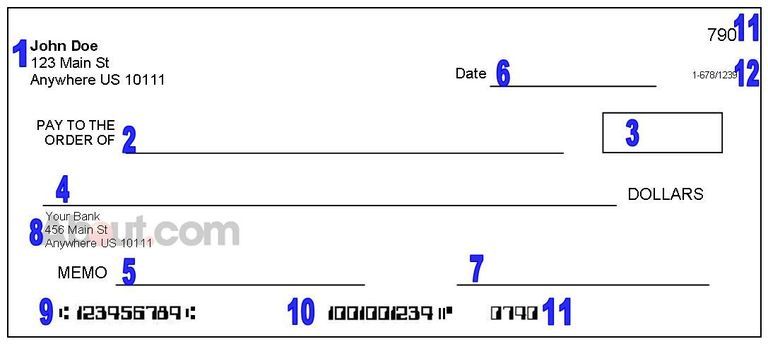

1 | arrow_right_alt | personal information |

5 | arrow_right_alt | Payee |

11 | arrow_right_alt | amount/dollar box |

9 | arrow_right_alt | amount/word format |

2 | arrow_right_alt | purpose of check, reminder |

3 | arrow_right_alt | date |

10 | arrow_right_alt | signature line |

7 | arrow_right_alt | bank information |

6 | arrow_right_alt | routing number |

4 | arrow_right_alt | bank account number |

8 | arrow_right_alt | check number |