U1: Ch1 Taxes & Basics - Classwork (2025)

star

star

star

star

star

Last updated 22 days ago

31 questions

Note from the author:

Chapter Notes

Unit 1 Covers the basics of Algebra and some arithmetic connected to taxes. We will look at how they are paid and used.

Chapter 1 Objectives:

- Define rational numbers

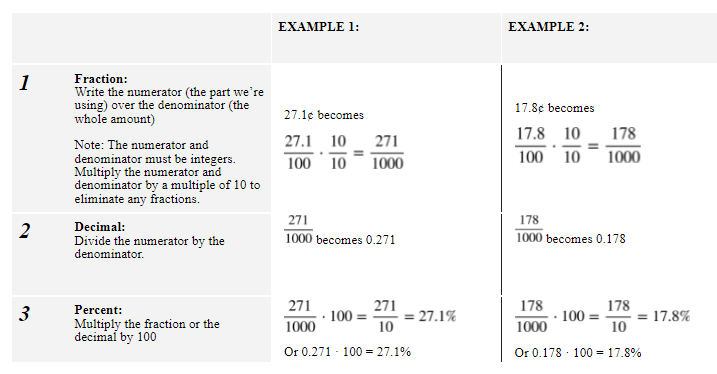

- Express rational numbers as a fraction, decimal, and percent, and convert between the three

- Multiply rational numbers to solve word problems

- Understand how the federal government spends income tax dollars

- Explain the similarities and difference between payroll taxes and self-employment taxes

- Explain how sales tax is calculated, and how it differs between states and local areas

- Calculate percentages

- Read a pay stub

- Complete a W-4

- Identify common payroll deductions

Chapter Notes

Unit 1 Covers the basics of Algebra and some arithmetic connected to taxes. We will look at how they are paid and used.

Chapter 1 Objectives:

- Define rational numbers

- Express rational numbers as a fraction, decimal, and percent, and convert between the three

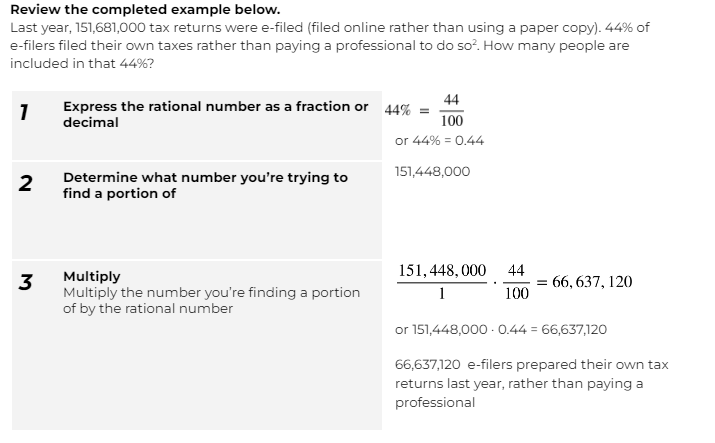

- Multiply rational numbers to solve word problems

- Understand how the federal government spends income tax dollars

- Explain the similarities and difference between payroll taxes and self-employment taxes

- Explain how sales tax is calculated, and how it differs between states and local areas

- Calculate percentages

- Read a pay stub

- Complete a W-4

- Identify common payroll deductions

Section 1: How Taxes are Used

0

0

0

0

0

0

0

0

0

Section 2: Converting between fraction/decimal/percent

0

0

0

0

0

Section 3: Rational Numbers

0

0

0

0

1

1

1

Section 4: 5 Point Quiz Review

1

1

1

2

2

2

3

Section 5: Multiplying Rational Numbers

0

0

0

Section 6: Apply It (10 points - double quiz!)