U1 Ch2: Taxes & Basics Classwork

star

star

star

star

star

Last updated 11 months ago

69 questions

Note from the author:

Click here for chapter notes

Objectives:

- Calculate percentages

- Read a pay stub

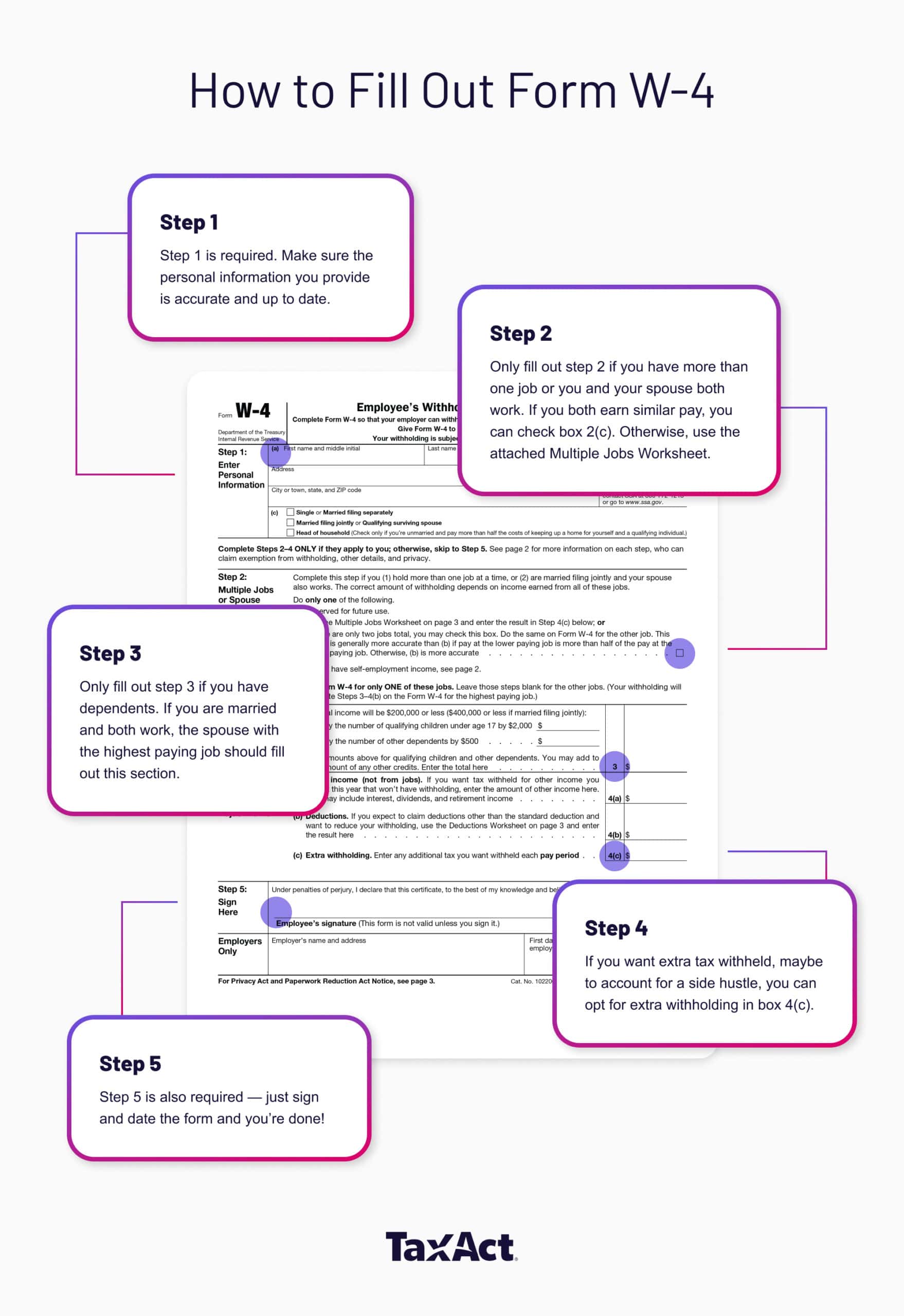

- Complete a W-4

- Identify common payroll deductions

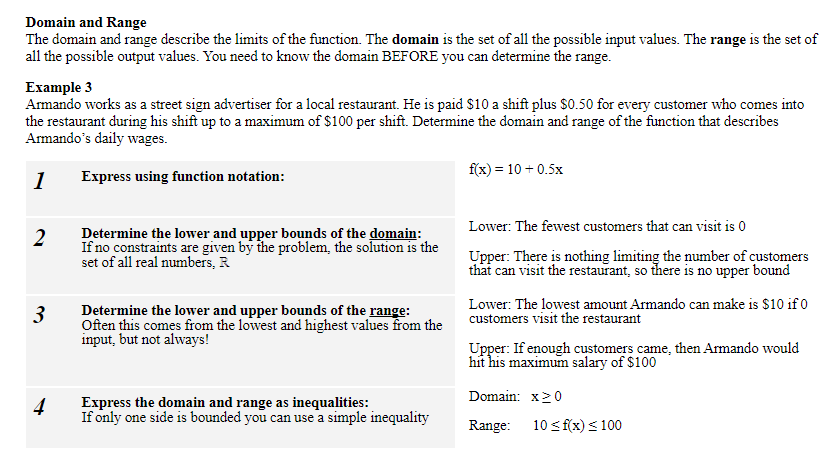

- Understand and create an expression in function notation

- Evaluate the domain and range of a function from its constraints

- Represent real world scenarios as a function

- Evaluate functions for a specific input value or set of values

- Understand how to model and calculate different types of taxes

Click here for chapter notes

Objectives:

- Calculate percentages

- Read a pay stub

- Complete a W-4

- Identify common payroll deductions

- Understand and create an expression in function notation

- Evaluate the domain and range of a function from its constraints

- Represent real world scenarios as a function

- Evaluate functions for a specific input value or set of values

- Understand how to model and calculate different types of taxes

Section 1: Paycheck Overview

0

0

0

0

0

0

0

0

0

0

0

0

0

Section 2: Types of Income

0

0

0

0

0

0

0

0

0

0

0

0

0

0

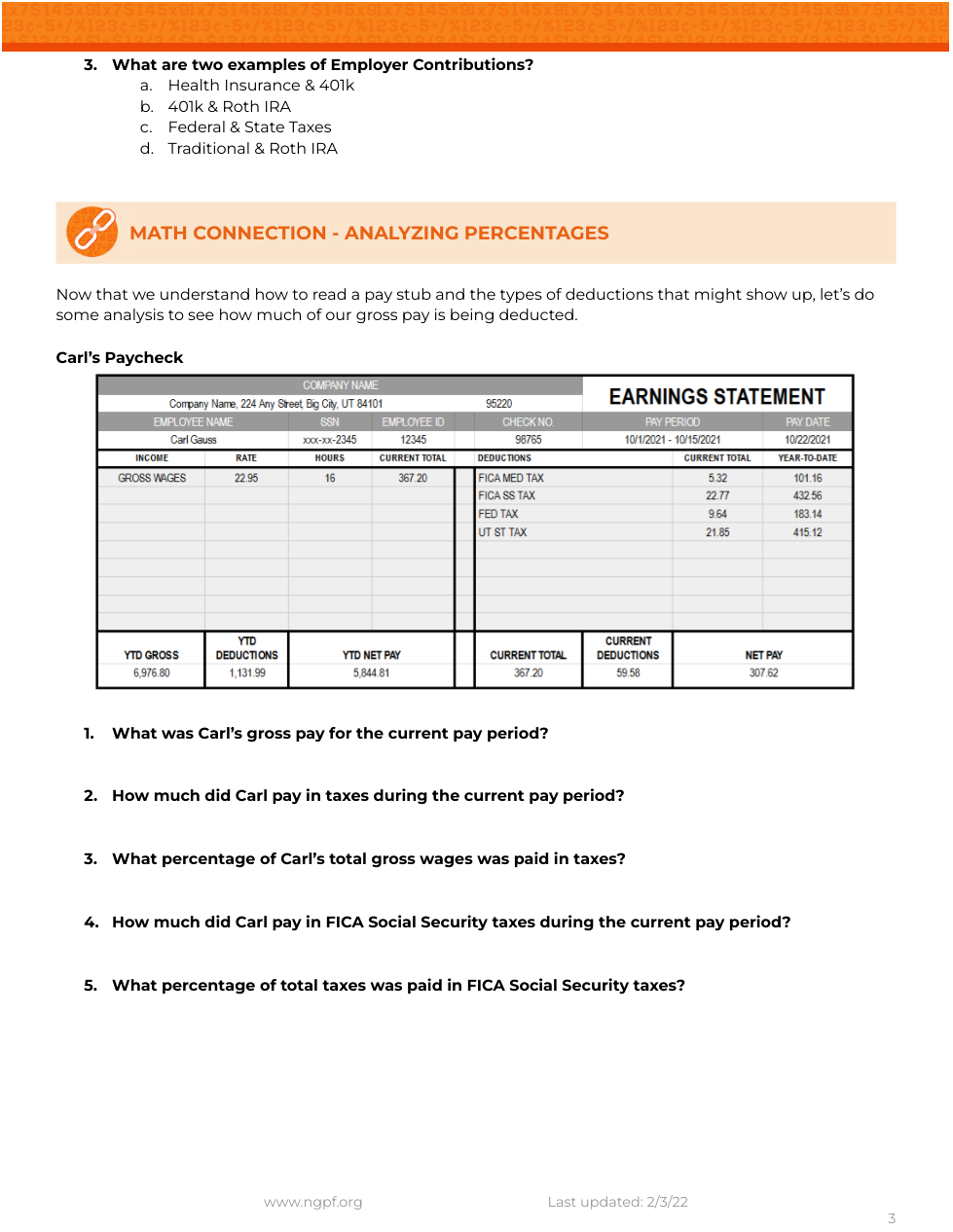

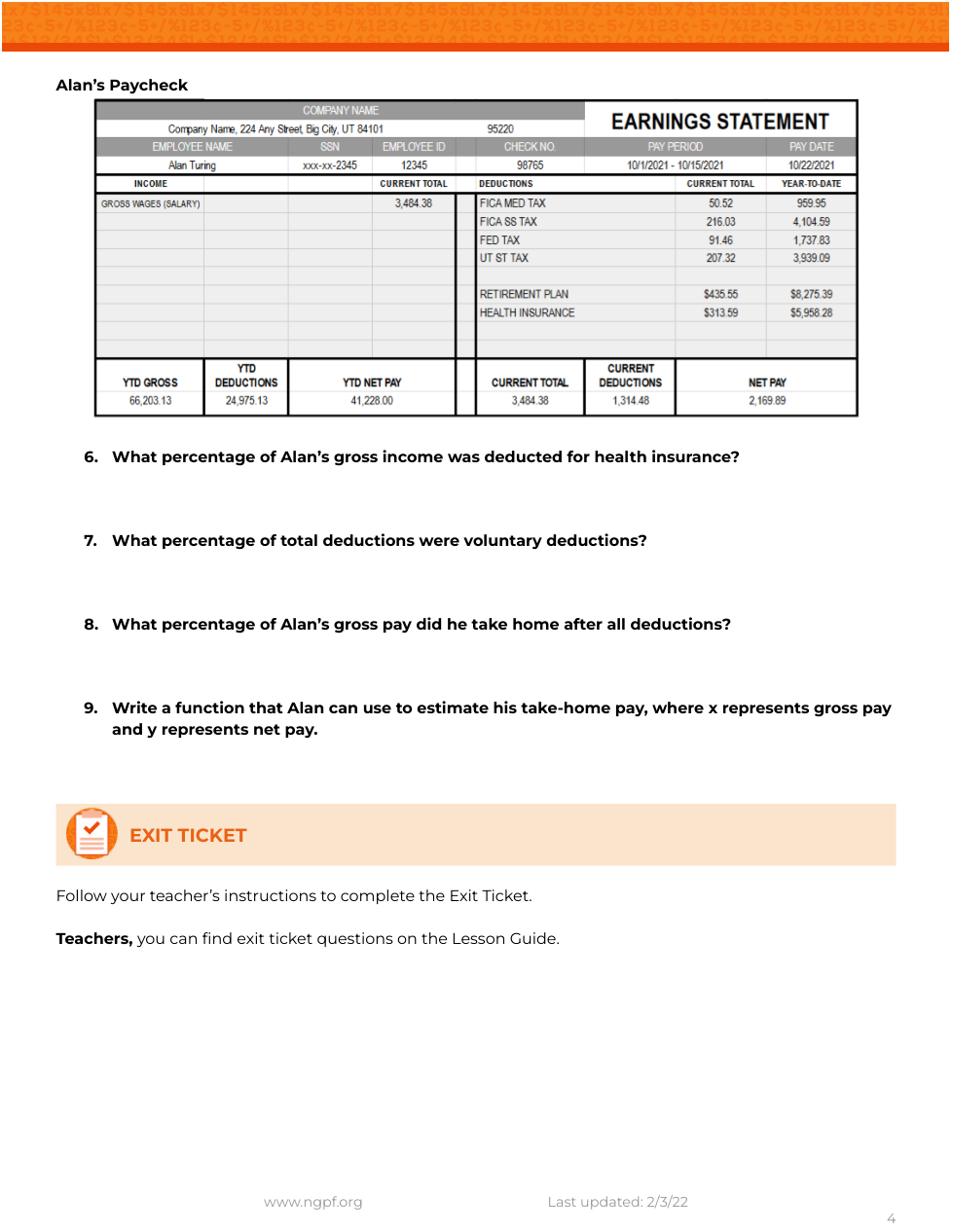

Section 3: Analyzing Percentages

0

0

0

1

1

Section 4: Function Notation and Evaluating Functions

0

0

0

0

0

0

0

0

0

Section 5: Review for Five Point Practice

1

1

1

2

2

3

3

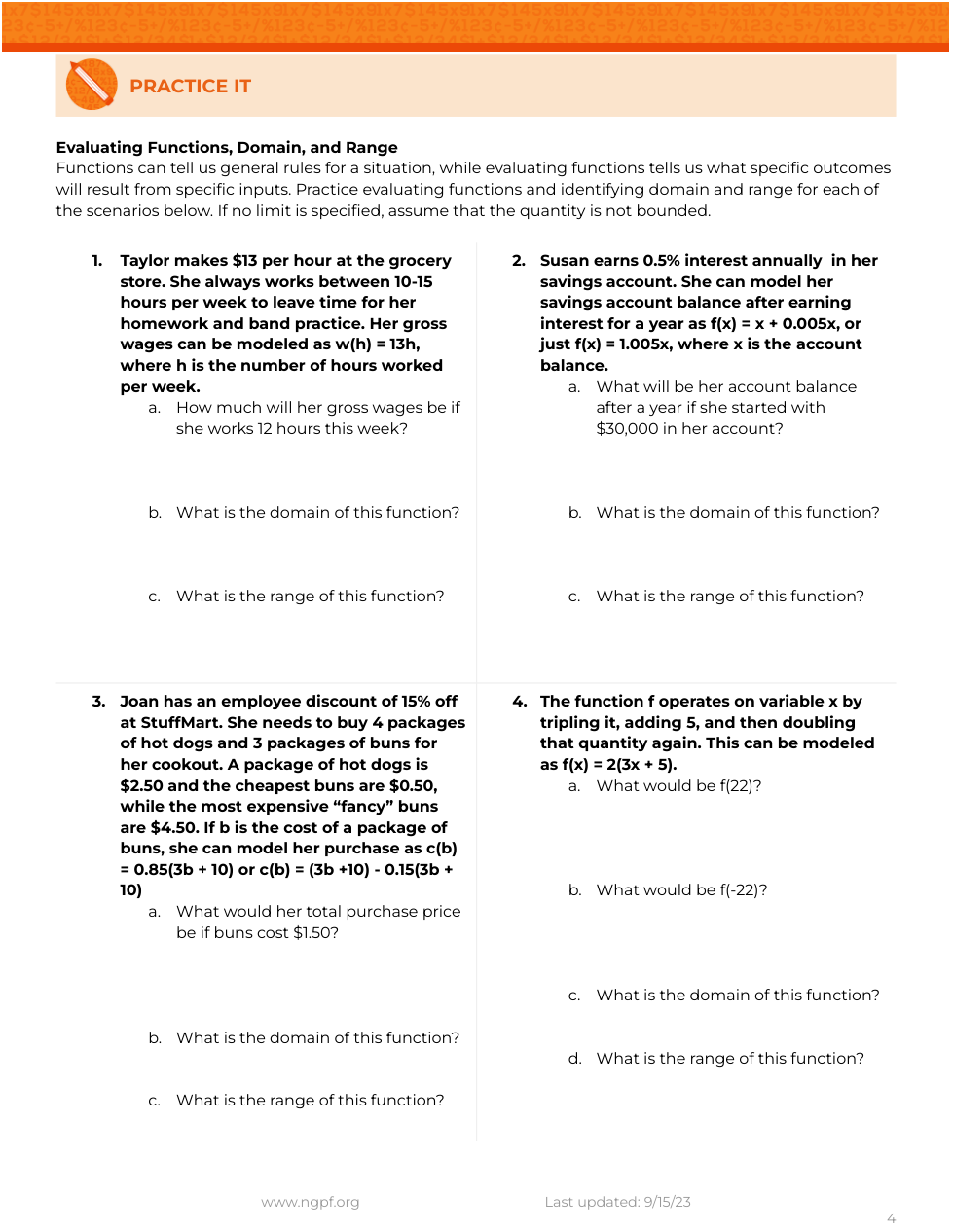

Section 6: Function Domain and Range

Section 7: Apply It