U2 Ch1: Checking Accounts and Linear Equations

star

star

star

star

star

Last updated 11 months ago

61 questions

Note from the author:

Objectives:

- Explain the purpose and benefits of a checking account

- Read a bank statement

- Analyze the consequences of not being in the banking system

- Compare two different graph representations of account balance data

- Analyze real-world data presented in a pie chart and bar graph.

Objectives:

- Explain the purpose and benefits of a checking account

- Read a bank statement

- Analyze the consequences of not being in the banking system

- Compare two different graph representations of account balance data

- Analyze real-world data presented in a pie chart and bar graph.

Section 1: Paying for Things

0

0

0

0

0

0

Section 2: Checking Accounts

0

0

0

0

0

0

0

0

0

Section 3: Unbanked

0

0

0

0

0

0

Section 4: Bank Fees

0

0

0

0

0

0

0

0

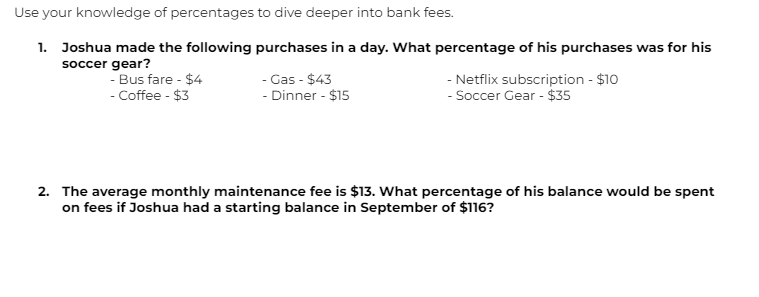

Section 5: Percentages and Bank Fees

Section 6: 5pt Quiz

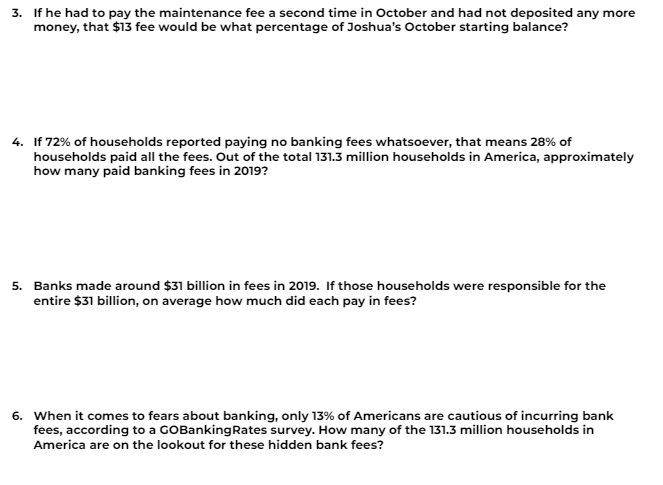

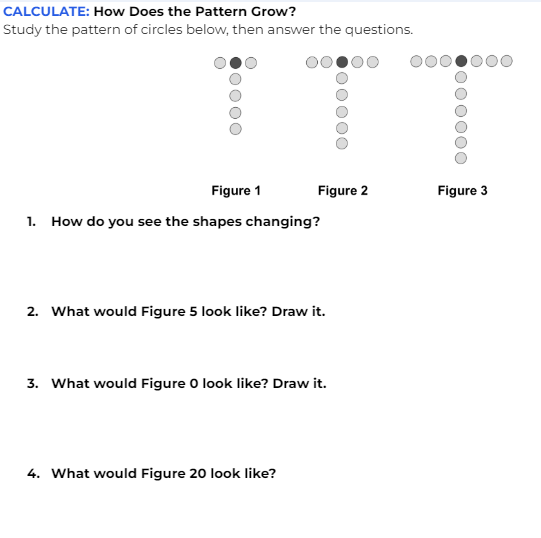

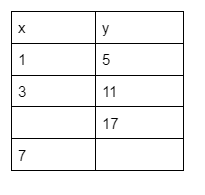

Section 7: Linear Patterns

0

0

0

0

0

0

Section 8: Apply It Review

1

1

1

1

1

1

1

Section 9: Apply It