Micro Unit 6.5 CW: Types of Taxes (Matching)

star

star

star

star

star

Last updated 9 months ago

4 questions

1

| Draggable item | arrow_right_alt | Corresponding Item |

|---|---|---|

total taxes/total income | arrow_right_alt | tax incidence |

intermediary collects the tax and then passes it on to the government | arrow_right_alt | average tax rate |

federal tax paid by person who gives a large gift valued over $14,000; progressive; direct | arrow_right_alt | marginal tax rate |

all incomes taxed same % | arrow_right_alt | tax bracket |

who actually bears the burden of paying tax | arrow_right_alt | direct tax |

tax paid by the consumer on a specific good (alcohol, tobacco, gasoline); regressive; indirect; benefit principle | arrow_right_alt | indirect tax |

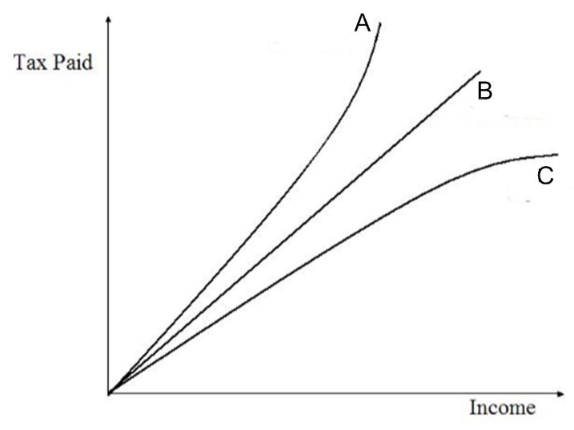

more money you earn, greater % of income you pay in taxes | arrow_right_alt | ability to pay principle |

taxes covered by FICA; income for retirees, survivors, disabled; regressive; employers= indirect; employees= direct | arrow_right_alt | proportional tax (flat tax) |

tax on income earned (wages, tips, earnings on savings); progressive; direct; based on ability to pay principle | arrow_right_alt | progressive tax |

death tax; federal tax on someone who has died; progressive; direct | arrow_right_alt | regressive tax |

change in taxes/ change in income | arrow_right_alt | personal income tax |

state and local taxation of the value of property; regressive; indirect= landlords, direct=homeowners | arrow_right_alt | sales tax |

marginal tax rate (what you pay on your last dollar) | arrow_right_alt | excise tax |

tax paid by the consumer on a specific good (alcohol, tobacco, gasoline); regressive; indirect; benefit principle | arrow_right_alt | property tax |

philosophy that taxation should be based upon one's ability to pay (rather than amount of benefit received) | arrow_right_alt | social security |

less money you earn, greater % of income you pay in taxes | arrow_right_alt | estate tax |

collected from person who is being taxed | arrow_right_alt | gift tax |